原创 明白知识er 明白知识 来自专辑对世界的态度

克鲁格曼是新凯恩斯主义经济学派的代表人物之一,他主要研究的领域是国际贸易、国际金融、货币危机与汇率变化理论。2008年,他荣获诺贝尔经济学奖。

这次采访,是想从他嘴里套出关于美国经济的下一步走向。

克鲁格曼说,在疫情没有得到控制前,过早重启经济的做法非常愚蠢,因为其目的只是为了追求一个漂亮的就业数据。

对于这样的举动,克鲁格曼用一个词来形容:「自私」(Selfishness),其结果无所谓利弊,因为这是一个「双输命题」。

就在采访同日,克鲁格曼在《纽约时报》发表了一篇名为《「自私邪教」害美国一败涂地》。文章指出,美国共和党政府试图通过放松疫情控制来重振经济,结果既输给了新冠病毒,也输了经济。

终归到底,这是一种在灾难面前不负责任的表现。

图片来源:CNBC采访截图

尽管如此,克鲁格曼仍表明自己是一个乐观主义者,他将2008年的金融危机与此次危机做了一个对比。

在2008年的金融危机中,美国经济面临的是基础性的问题,即消费债务(Consumer Debt)的难以解决。因此,渡过那场危机花了许多年的时间。而这一次,克鲁格曼表示,只要疫情得到控制,美国经济就能快速恢复。

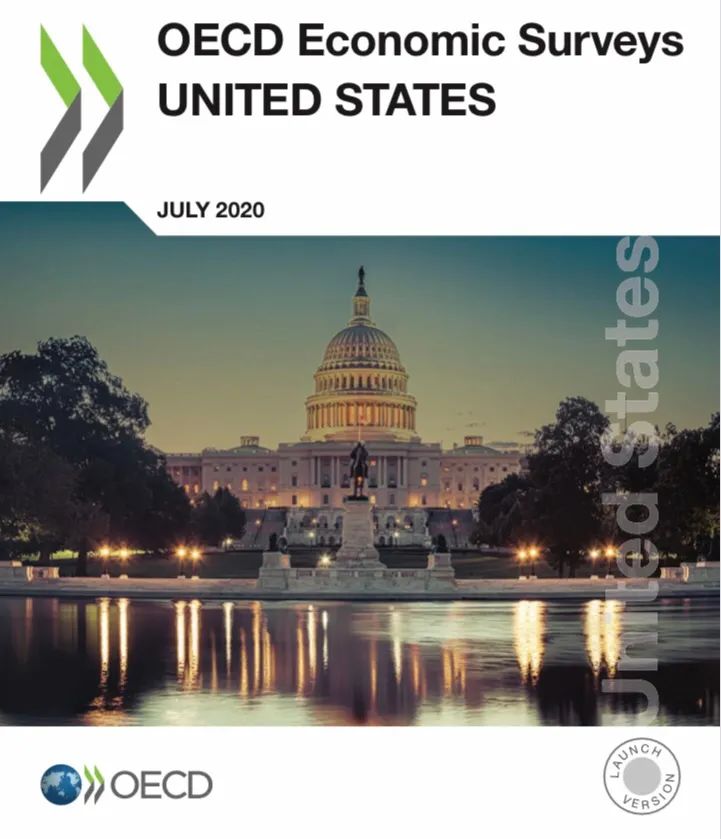

这样的情况似乎已经开始出现,第二个问题就是如何看待5月和6月美国工作岗位增长,失业率下降。

图片来源:CEIC

克鲁格曼不免悲观地指出,5月和6月的就业率增长可能只是「昙花一现」,需要更长时间的观察到底是不是「虚假希望」。

在克鲁格曼看来,政府制定了许多刺激经济复苏的政策,却没有把重心放在控制疫情上,从长期来看,经济可能从两方面受到损害。

第一是学校停课。

疫情致使学校不得已停课。对于中小学生来说,长期的远程授课并不适合,教室是必要的,但另一方面,学校也容易成为病毒的培养皿。在这一点上,可能要采取「尴尬」的折中手段,既要保护健康,也尽可能恢复面对面授课。

可对于毕业生来说,危害是显而易见的。停课不仅会对学业造成影响,他们同时将面临一个十分糟糕的劳动力市场。政府不控制疫情,劳动力市场的低迷至少将持续一年。并且,对于整个国家的经济来说,也会错失解决问题的后路,还会造成更多的隐患。

毕业生无法找到工作,当前美国的经济问题也就失去了解决后路。

第二,是失业救济补助即将到期失效。

克鲁格曼在采访中提醒,针对疫情的失业救济金即将在7月31日失效。这项救济补助源于3月27日,川普签署的《新冠病毒援助、救济和经济安全法案》(简称「CARES法案」)。该法案为美国企业、个人和家庭提供了多项税收优惠和救济措施。

该法案最初是美国众议院的民主党人发起的,最后为了能让共和党人通过,只能选择妥协,收窄救济覆盖范围,最终才使川普同意签署生效。

图片来源:The New York Times

无论如何,CARES法案大大增加了困在家中无法工作的工人的援助。具体地说,这项法案提高了救济水平,每个失业者能收到每周600美元的补助金,最长可领取4个月。并且之前不在保险范围内的临时工人,也能领取到福利救济。

7月31日法案失效后,失去了这份救济补助,数百万的美国工人的收入将至少暴跌60%。

在克鲁格曼另一篇发于《纽约时报》的文章《下一场灾难仅几天之遥》中,他补充道,失业救济金失效的7月31日是周五,而美国各州的失业救济周通常在周六或周日结束。因此,在大多数地方,疫情补助实际会在7月25日或26日结束。这说明,目前已经有很多州停止发放救济了。

数千万美国人即将遭遇极端贫困。因此,格鲁克曼称,「下一场灾难仅隔几天之遥」。

第三个问题,是很多人都关心的,最近股市上涨趋于「狂热」的现象。

疫情曾在3月份直接造成了股市多次熔断,不过,目前看来,股市正在看涨。从道琼斯工业指数来看,从3月23日之后都在持续增长,而标准普尔500指数也是如此,本月上涨了4%以上。

图片来源:Bloomberg

似乎经济正在恢复的过程中,但克鲁格曼强调:

「股市从来都不是市场和整体经济状况的良好指标。」

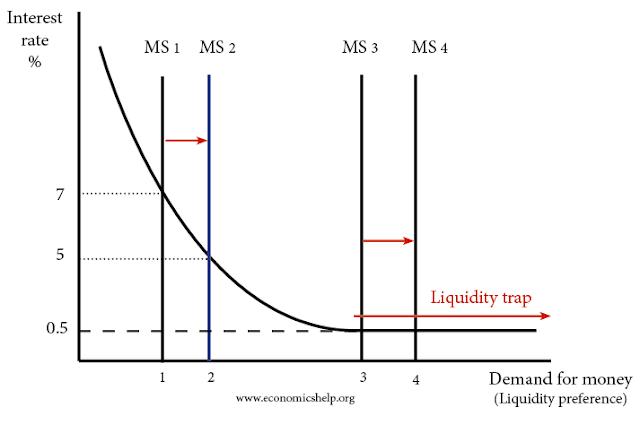

因为股市中存在着某种「庞氏骗局」(Ponzi scheme)。人们将钱投入股市,只是因为接下来会有人跟进,前一波人挣着后一波人的钱,本质上说,这是一种「经济泡沫」。美联储虽然投入大量资金来「润滑」市场,但已经没有更多有力的后招。

克鲁格曼认为,这种状况将把经济领入「流动性陷阱」(liquidity trap)。也就是说,用货币政策来刺激经济已经不太有效,不管是降低利率还是增加货币供应量,都无济于事。

图片来源:economicshelp

美国经济很可能面临着通货紧缩,需求不足的局面。到时,持有流动资产的人将不再愿意投入资金,股市的上涨「假象」就此停止,经济陷于萧条。

如今,摆在美国经济面前的,是一个两难境地。一方面,疫情的风险始终持续着,没有要结束的迹象;另一方面,虽然川普政府急于恢复经济,可接下来数月的失业率不容乐观。

美国为什么会陷入这样一个不难预料的两难境地呢?或者不如说,川普政府为什么在疫情和经济危机面前,丝毫没有紧迫感?

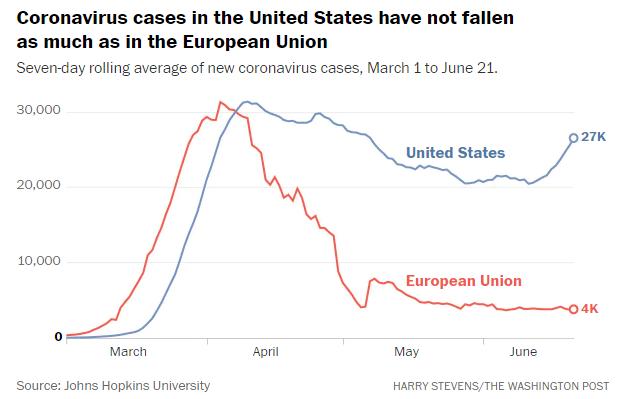

克鲁格曼认为,主要有两个原因。一是川普政府沉湎于经济的V型复苏幻想中,认为就业恢复即将到来,因此当下对失业者实施救济援助不是明智之举。但川普没想到的是,美国的新冠疫情曲线与其他国家和地区走势不同。

图片来源:The Washington Post

美国迎来了第二个疫情高峰,美国经济也随之再一次陷入困境。

克鲁格曼指出的另一个原因,则是白宫的共和党人坚信,在经济萧条的情况下帮助失业者,反而会助长懒惰,阻碍就业。因此没必要采取救助措施。

那么,对身陷困境,并且即将雪上加霜的美国来说,现在应该重启经济吗?

克鲁格曼在采访中不无讽刺地说,「(白宫)甚至没有认真讨论过,现在重启经济是否太早。」

他直接表示,正是由于在疫情没有得到控制前就重启经济,导致了美国今天的双重困境。

总而言之,美国经济下一步的走向并不乐观,很可能是W型的经济复苏,也可能是长期衰落。

在疫情得到控制之前,未来仍不明朗。■

(后台回复「经济」即可获得OECD发布的美国经济调查报告)

参考资料

Elizabeth Schulze. Nobel laureate Paul Krugman sees 'mania' by stocks investors, driven by a 'FOMO' market. CNBC.

Lee Moran. Paul Krugman: ‘One Way Or Another, The Economy Is Going To Lock Down Again’. Huffpost.

Paul Krugman. The Cult of Selfishness Is Killing America. NYTimes.

Paul Krugman. The Next Disaster Is Just a Few Days Away. NYTimes.

以下是克鲁格曼的文章原文

The Next Disaster Is Just a Few Days Away

Millions of unemployed Americans face imminent catastrophe.

Some of us knew from the beginning that Donald Trump wasn’t up to the job of being president, that he wouldn’t be able to deal with a crisis that wasn’t of his own making. Still, the magnitude of America’s coronavirus failure has shocked even the cynics.

At this point Florida alone has an average daily death toll roughly equal to that of the whole European Union, which has 20 times its population.

How did this happen? One key element in our deadly debacle has been extreme shortsightedness: At every stage of the crisis Trump and his allies refused to acknowledge or get ahead of disasters everyone paying attention clearly saw coming.

Blithe denials that Covid-19 posed a threat gave way to blithe denials that rapid reopening would lead to a new surge in infections; now that the surge is upon us, Republican governors are responding sluggishly and grudgingly, while the White House is doing nothing at all.

And now another disaster — this time economic rather than epidemiological — is just days away.

To understand the cliff we’re about to plunge over, you need to know that while America’s overall handling of Covid-19 was catastrophically bad, one piece — the economic response — was actually better than many of us expected. The CARES Act, largely devised by Democrats but enacted by a bipartisan majority late in March, had flaws in both design and implementation, yet it did a lot both to alleviate hardship and to limit the economic fallout from the pandemic.

In particular, the act provided vastly increased aid to workers idled by lockdowns imposed to curb the spread of the coronavirus. U.S. unemployment insurance is normally a weak protection against adversity: Many workers aren’t covered, and even those who are usually receive only a small fraction of their previous wages. But the CARES Act both expanded coverage, for example to gig workers, and sharply increased benefits, adding $600 to every recipient’s weekly check.

These enhanced benefits did double duty. They meant that there was far less misery than one might otherwise have expected from a crisis that temporarily eliminated 22 million jobs; by some measures poverty actually declined.

They also helped sustain those parts of the economy that weren’t locked down. Without those emergency benefits, laid-off workers would have been forced to slash spending across the board. This would have generated a whole second round of job loss and economic contraction, as well as creating a huge wave of missed rental payments and evictions.

So enhanced unemployment benefits have been a crucial lifeline to tens of millions of Americans. Unfortunately, all of those beneficiaries are now just a few days from being thrown overboard.

For that $600 weekly supplement — which accounts for most of the expansion of benefits — applies only to benefit weeks that end “on or before July 31.” July 31 is a Friday. State unemployment benefit weeks typically end on Saturday or Sunday. So the supplement will end, in most places, on July 25 or 26, and millions of workers will see their incomes plunge 60 percent or more just a few days from now.

Two months have gone by since the House passed a relief measure that would, among other things, extend enhanced benefits through the rest of the year. But neither Senate Republicans nor the White House has shown any sense of urgency about the looming crisis. Why?

Part of the answer is that Trump and his officials are, as always, far behind the coronavirus curve. They’re still talking about a rapid, V-shape recovery that will bring us quickly back to full employment, making special aid to the unemployed unnecessary; they’re apparently oblivious to what everyone else sees — an economy that is stumbling again as the coronavirus surges back.

Delusions about the state of the economic recovery, in turn, allow conservatives to indulge in one of their favorite zombie ideas — that helping the unemployed in a depressed economy hurts job creation, by discouraging people from taking jobs.

Worrying about employment incentives in the midst of a pandemic is even crazier than worrying about those incentives in the aftermath of a financial crisis, but it seems to be at the core of White House thinking (or maybe that’s “thinking”) about economic policy right now.

One last thing: My sense is that Republicans have a delusional view of their own bargaining position. They don’t seem to realize that they, not the Democrats, will be blamed if millions are plunged into penury because relief is delayed; to the extent that they’re willing to act at all, they still imagine that they can extract concessions like a blanket exemption of businesses from pandemic liability.

Maybe the prospect of catastrophe will concentrate Republican minds, but it seems more likely that we’re heading for weeks if not months of extreme financial distress for millions of Americans, distress that will hobble the economy as a whole. This disaster didn’t need to happen; but you can say the same thing about most of what has gone wrong in this country lately.

原标题:《诺奖得主克鲁格曼:美国经济下一步会如何?》